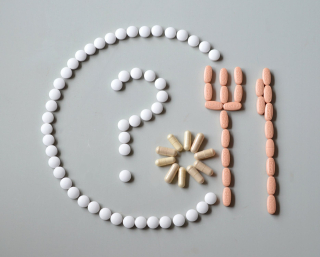

There is more to an estate plan than just a will. Other assets are included in estate plans, including financial accounts. Most financial accounts function the same for estate planning purposes. However, health savings accounts—often referred to as HSAs are treated differently in estate plans and from a tax perspective. Health savings accounts allow individuals to contribute money to them to then be used for medical expenses. Because health savings accounts are treated differently than other accounts, below are common questions and explanations about HSAs in estate plans.

What is a Health Savings Account?

A health savings account (HSA) is a health insurance account where qualified individuals can contribute up to $3,600 per year—and $7,200 for families—on a pre-tax basis. These funds can then be withdrawn, tax-free, to use on medical expenses. However, individuals can only contribute to health savings accounts if they have a high deductible health plan.

Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog