The only way to make sure that your wishes are carried out after your death is to have the proper estate planning documents prepared in advance, according to a post from WMUR.com, "Money Matters: Common estate planning mistakes." Some people make the mistake of thinking that estate planning will be extremely complicated, while others think it will be far simpler than it ever could be. While every situation is different, there are a number of mistakes that are common at every income and asset level.

The only way to make sure that your wishes are carried out after your death is to have the proper estate planning documents prepared in advance, according to a post from WMUR.com, "Money Matters: Common estate planning mistakes." Some people make the mistake of thinking that estate planning will be extremely complicated, while others think it will be far simpler than it ever could be. While every situation is different, there are a number of mistakes that are common at every income and asset level.

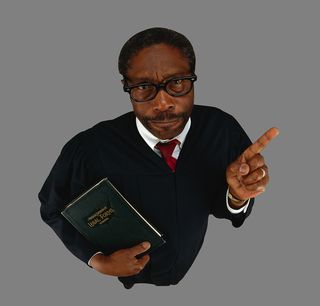

Failing to plan. Many of us don't have a will—but like it or not you do have an estate plan. The plan is called the law of your state and the probate judge. If you die without a will, your estate will be divided according to intestacy laws. In that case, there's no guarantee this will be what you wanted. A one-page will or a more complex plan with other strategies like a trust can help reduce estate taxes, save on administrative costs, and put you in the driver's seat when deciding how your assets are to be distributed to your heirs, charities, or to help a family member with special needs. Another important point: in many states a will is the only way that you can name a guardian for your minor children. So, if you move from one state to another, be sure to check local laws.

Failing to maximize your marital estate exemption. The new portability law provisions ease some of the estate tax planning burden by allowing each individual a $5.43 million federal estate tax exemption in 2015. If one spouse dies without using up his or her $5.43 million, the unused portion may be transferred to the other spouse for use at the survivor's death (hence the term "portable."). You should also remember to investigate any state estate taxes when reviewing your strategy and make certain to discuss how portability is elected with your attorney.

A jumbo sized battle in a high profile and seemingly never-ending estate matter highlights what may appear to be a minor detail in estate planning but what is in fact an important consideration: the executor fee.

A jumbo sized battle in a high profile and seemingly never-ending estate matter highlights what may appear to be a minor detail in estate planning but what is in fact an important consideration: the executor fee. Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog