Your calling serves patients, but it also exposes wealth to risk. Even with strong insurance, a single claim, business dispute, or personal guarantee can threaten savings. A Dallas-ready estate plan builds layers of protection while keeping life simple for your family.

Start With the Protections Texas Already Gives You

Texas homestead laws shield your primary residence within acreage limits. Qualified retirement plans and many IRAs receive powerful statutory protection. Max out those vehicles, keep beneficiary forms current, and store statements where your spouse or executor can find them. Simple steps form a sturdy first line of defense.

Separate Your Professional and Personal Worlds

Operate through the right entity—a professional association (PA) or professional LLC (PLLC). Keep clean books, separate accounts, and minutes for major decisions. Sign contracts as an officer of the entity, not in your personal capacity, and avoid commingling. For investments, consider a limited partnership with an LLC as general partner to add charging-order protection and limit creditor leverage.

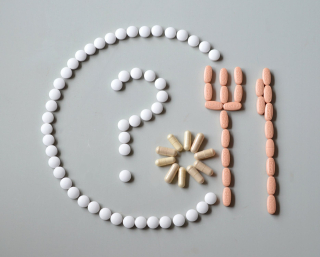

Buy Insurance Like a Realist, Not an Optimist

Carry malpractice limits that match your specialty’s risk. Add an umbrella policy for non-practice liability, and price tail coverage when changing jobs or retiring so past care remains covered. Insurance buys time for your asset structure to work and supplies defense dollars when emotions run high.

Title Assets With Purpose and Clarity

In a second marriage, use marital agreements to sort community from separate property. A community-property survivorship agreement can move certain accounts directly to your spouse, while a trust can preserve other assets for children. Avoid casual personal guarantees on practice loans; one signature can pull protected assets into a creditor’s reach.

Build Protective Trusts the Right Way

If you want to help family during life, consider irrevocable trusts that keep assets outside your estate yet accessible for them—such as a spousal lifetime access trust (SLAT) paired with life insurance in an irrevocable life-insurance trust (ILIT). Make gifts in ordinary times, not after a claim appears. Courts scrutinize timing; steady, well-documented planning carries credibility.

Safeguard the Practice and Income Stream

Create or update a buy-sell agreement with partners so a disability or death does not freeze distributions or voting. Fund that agreement with life and disability coverage to provide liquidity. Confirm that accounts receivable, equipment leases, and EHR contracts have succession language so billing and operations continue smoothly during transitions.

Prepare for Incapacity and Protect Privacy

Sign medical and financial powers of attorney so a trusted agent can manage accounts, apply for benefits, and authorize care if you cannot. Add explicit digital-asset permissions for EHR portals, billing software, and cloud storage. Inventory passwords and 2FA backups in a secure vault your agent can access. Speed matters when payroll and schedules depend on your systems.

Keep Your Plan Current

Review everything every two years or after major changes in compensation, insurance markets, or practice ownership. Update beneficiary forms, confirm entity filings with the Secretary of State, and refresh your list of accounts and policies. Small maintenance keeps the shield strong.

Put a durable, physician-smart plan around your family and your practice. To design a protection strategy that balances simplicity and strength, call McCulloch & Miller, PLLC at (713) 903-7879 and start building your safety net today.

Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog