The unknown about spending in retirement is not just whether it will be higher or lower, but when during the course of retirement, you’ll be spending more or less. If you downsize, housing costs will decrease, but if you travel more, recreational spending will rise.

The unknown about spending in retirement is not just whether it will be higher or lower, but when during the course of retirement, you’ll be spending more or less. If you downsize, housing costs will decrease, but if you travel more, recreational spending will rise.

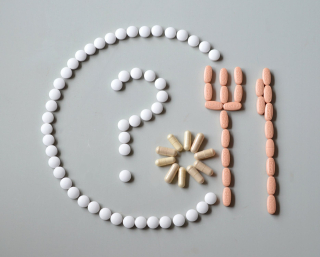

According to a recent article from Investopedia, “How to Plan for Medical Expenses in Retirement,” healthcare is likely to be the biggest expense in retirement. A survey from Fidelity Investments found that a 65-year-old newly retired couple should budget about $285,000 for medical expenses in retirement. It is better to have the money set aside than to be surprised by the cost. That number also does not include long-term care. Depending on where you live, those costs can range from $18,720 for adult day care services to $100,375 for a private room in a nursing home.

Despite saving and preparing for retirement their entire lives, many retirees aren't mentally or financially prepared for these types of expenses. A survey by HSA Bank found that 67% of adults 65 and older thought that they’d need less than $100,000 for healthcare. However, Fidelity calculated that males 65 and older will need $133,000—and females, $147,000—to pay for healthcare in retirement.

Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog