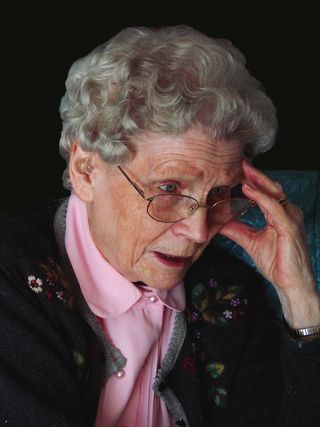

Although many people feel frustrated by elder guardianship systems designed to protect adults no longer able to fend for themselves, what’s even sadder are the many instances where it turns out that the elder guardianship system is doing its job properly –and strangers have no choice except to step in and make decisions that families and friends simply cannot.

Although many people feel frustrated by elder guardianship systems designed to protect adults no longer able to fend for themselves, what’s even sadder are the many instances where it turns out that the elder guardianship system is doing its job properly –and strangers have no choice except to step in and make decisions that families and friends simply cannot.

Elder guardianship can be complicated. Many question if our elderly loved ones are getting the proper care they deserve in those situations.

The (Sarasota, FL) Herald-Tribune, in a recent article titled “The takeaway lesson on elder guardianship,”says that one woman contacted the newspaper writer from an assisted-living facility, saying she had been incarcerated against her will. She moved to be closer to her son, but her daughter in Arizona had her under guardianship, which permitted limited contact with her son.

Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog