She says her father was suffering from Alzheimer’s disease, and that’s why he cut her out of the will. However, she also hadn’t seen or spoken to him for more than two decades.

She says her father was suffering from Alzheimer’s disease, and that’s why he cut her out of the will. However, she also hadn’t seen or spoken to him for more than two decades.

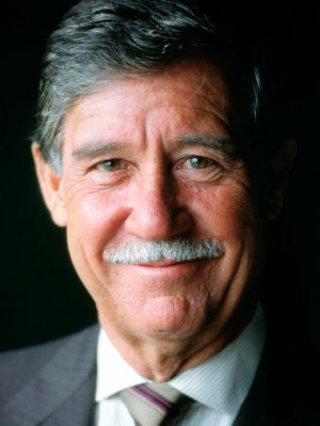

There’s a big estate battle brewing in Britain, where the 61-year-old daughter of Reg Grundy, Kim Robin Grundy, is challenging her father’s second wife with a will contest. Kim, who goes by the name Viola La Valette, is after part of her father’s $900 million estate. The fact that she refused to see him, even while he was supporting her, is not making her a popular figure.

Starts at 60’s article, “Reg Grundy’s daughter says he had Alzheimer’s when he cut her from will,” says that the TV tycoon, who was responsible for Australian shows like Neighbours and Wheel of Fortune, died in May 2016 at the age of 92. He left the majority of his estate to his wife.