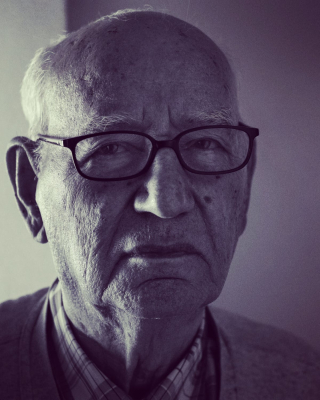

The fight over Conrad Prebys’ $1 billion estate continues, three years after the San Diego developer and philanthropist died.

The fight over Conrad Prebys’ $1 billion estate continues, three years after the San Diego developer and philanthropist died.

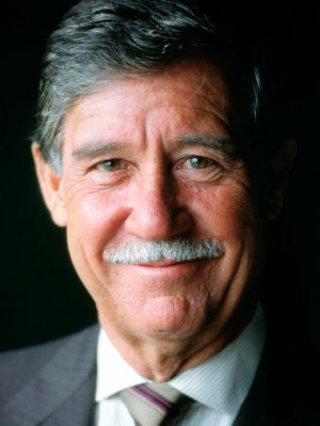

When the directors of the Conrad Prebys Foundation decided to give his son Eric $15 million, despite the fact that his father had left him out of the will, Preby’s longtime partner tried to sue them.

The San Diego Union-Tribune reported in the article “Court fight continues over control of $1 billion Prebys estate,” that in January, a San Diego Superior Court judge dismissed Debra Turner’s suit, holding that she had no legal standing to bring it. She then filed an amended complaint. However, the judge recently dismissed her lawsuit.

Houston Estate Planning and Elder Law Attorney Blog

Houston Estate Planning and Elder Law Attorney Blog